File:Securitization Market Activity.png

預覽大小:800 × 600 像素。 其他解析度:320 × 240 像素 | 640 × 480 像素 | 960 × 720 像素。

原始檔案 (960 × 720 像素,檔案大小:79 KB,MIME 類型:image/png)

檔案歷史

點選日期/時間以檢視該時間的檔案版本。

| 日期/時間 | 縮圖 | 尺寸 | 使用者 | 備註 | |

|---|---|---|---|---|---|

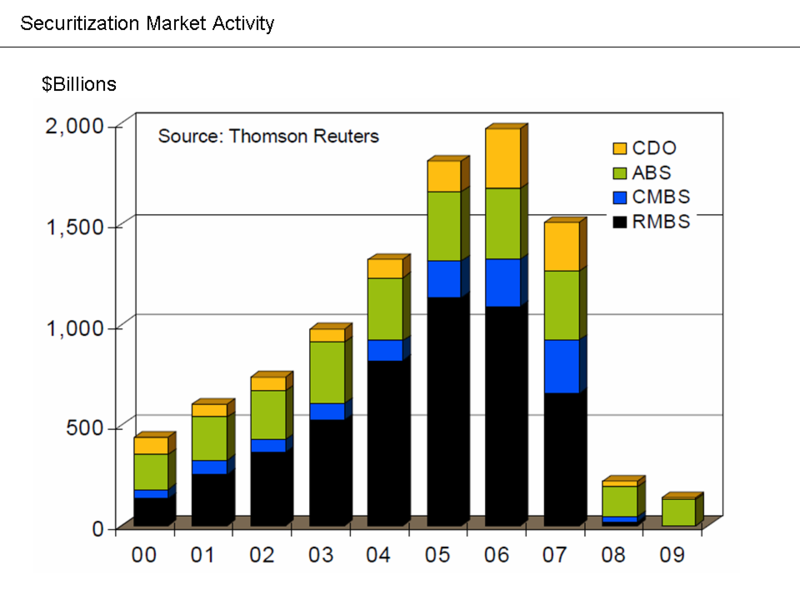

| 目前 | 2010年10月14日 (四) 01:07 |  | 960 × 720(79 KB) | Hideokun | {{Information |Description={{en|Image from Economist Mark Zandi's FCIC Testimony<br/> == Explanation == From Economist Mark Zandi's January 2010 testimony to the en:Financial Crisis Inquiry Commission: "The securitization markets also remain impai |

檔案用途

下列頁面有用到此檔案:

全域檔案使用狀況

以下其他 wiki 使用了這個檔案:

- cs.wikipedia.org 的使用狀況

- en.wikipedia.org 的使用狀況

- fa.wikipedia.org 的使用狀況

- hy.wikipedia.org 的使用狀況

- it.wikipedia.org 的使用狀況

- ja.wikipedia.org 的使用狀況

- vi.wikipedia.org 的使用狀況